Digital Technology to Increase Credit Access for MSMEs: Improving MSMEs’ credit access with big data

Start of implementation: 2020

Technology type: Fintech, big data

Technology service provider: Sukiplus

ADB Department: Economic Research and Development Impact Department (formerly known as the Economic Research and Regional Cooperation Department)

In line with ADB’s Operational Priorities (OP):

· Addressing remaining poverty and reducing inequalities

o Access to opportunities increased for the most vulnerable (OP1.3)

· Accelerating progress in gender equality

o Women’s economic empowerment increased (OP2.1)

Sari-sari stores are microenterprises that are common in neighborhoods across the Philippines, with around 1.3 million spread across the country. These establishments sell daily-needs products like canned goods, snack items, and beverages and make up approximately 30% of the country’s informal economy. Many buyers from these stores belong to low-income and lower-middle-income households.

Despite their proximity and affordability, many sari-sari stores, like other micro, small, and medium-sized enterprises (MSMEs), struggled to stay afloat during the pandemic. Many store owners needed to secure financing to survive the health crisis but experienced numerous challenges to accessing credit because they were unbanked. They also did not have credit scores, which banks and lending firms typically use to determine whether to approve or deny loan applications. Around 75% of sari-sari stores are owned and operated by women.

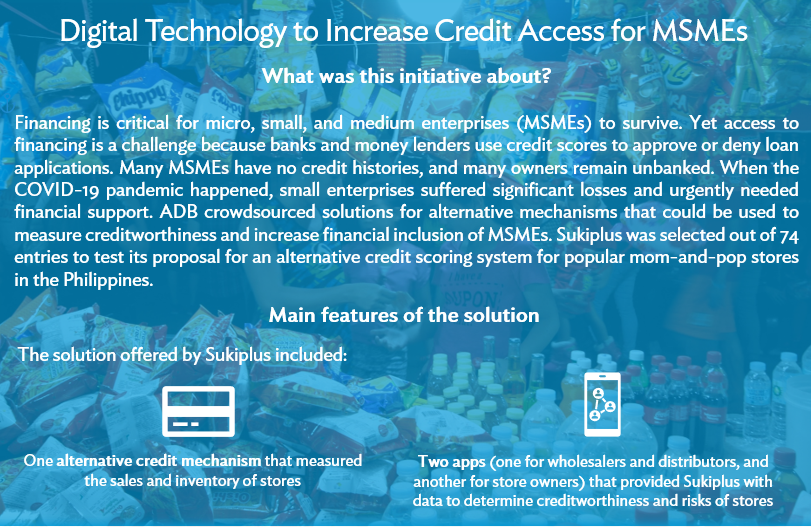

In 2020, ADB ran a challenge that sought an alternative credit scoring mechanism to enable entrepreneurs to acquire funding and help them recover from the impact of COVID-19. Sukiplus, a Philippines-based tech start-up, was selected out of 74 teams to test its proposed alternative credit scoring geared specifically for sari-sari store owners.

The credit scoring mechanism developed by Sukiplus used indicators that was based on information relevant to the running of a sari-sari store business (e.g., sales and inventory). These tailored indicators measure the pulse of the business and are excellent proxies for determining whether applicants will qualify for loans and have the capacity to pay them back. The need to spend additional hours on client assessments was removed since the indicators were readily available through two complementary apps that were developed by Sukiplus.

Sukiplus developed the ordering app, the credit score algorithm, and the loan structure and portfolio monitoring from early 2020 to the middle of 2021 as part of its target outputs in its engagement with ADB. The two types of loan structures differed in the loan size, interest rate, and payment schemes. The lowest possible loan size was ₱5,000 ($100), while the highest possible was ₱200,000 ($4,000).

Sukiplus engaged select wholesalers and retailers in Metro Manila to recommend sari-sari stores that were their regular customers with good standing. In exchange, they were provided with free access to the vendor-partner app developed by Sukiplus, which came bundled with a chatbot that allowed customers to order online from them. Data from suppliers provided Sukiplus with insights on the frequency of orders and sales of sari-sari store owners, enabling them to identify the regularity of orders and standard inventories of the stores.

Sukiplus then approached the recommended sari-sari store owners to invite them to fill up a loan application and provide basic documents, including a locally issued ID and a business permit. Sari-sari store owners that had their loans approved were provided a revolving line of credit for one year, which they could use exclusively for purchasing goods from the partner wholesalers and distributors. Sukiplus, which secured a money lender license in December 2020, provided the loans.

The vendor-partners were responsible for monitoring loan usage. The inventory repurchase of the store owner served as an early warning system for potential loan defaults. Non-repurchases or repurchases, smaller than the loan proceeds, could indicate that the inventory was idle, or the loan was used for something other than working capital. In these instances, a sales and collection team from Sukiplus investigated the situation and, if needed, recommended adjusting the loan amount to match the capacity of the sari-sari store to move the inventory.

Eighty-seven sari-sari stores signed up for the pilot. Out of this number, 50 were approved. Of this, 40 sari-sari stores availed of loans from Sukiplus, with an average loan value of ₱5,000 ($100). Ninety-eight percent of the stores proved to be good payors, which is an indication of the effectiveness of the algorithm to balance risk and improve credit access.

The solution offered by Sukiplus not only provided alternative ways to measure credit worthiness of the unbanked but also increased the financial literacy of participating sari-sari store owners. As majority of entrepreneurs are women without credit histories, the solution contributed to women’s financial inclusion and empowerment through their increased access to financing.