Robo-Advisor: Using Artificial Intelligence to Unearth Knowledge

Implementation: 2018–2019

Technology type: Artificial intelligence

Technology service provider: Oracle Labs

ITD’s Partner Department: Climate Change and Sustainable Development Department (formerly Sustainable Development and Climate Change)

In line with ADB’s Operational Approaches:

Promoting digital development and innovative technologies

Developing capacity

Adding value and promoting quality infrastructure

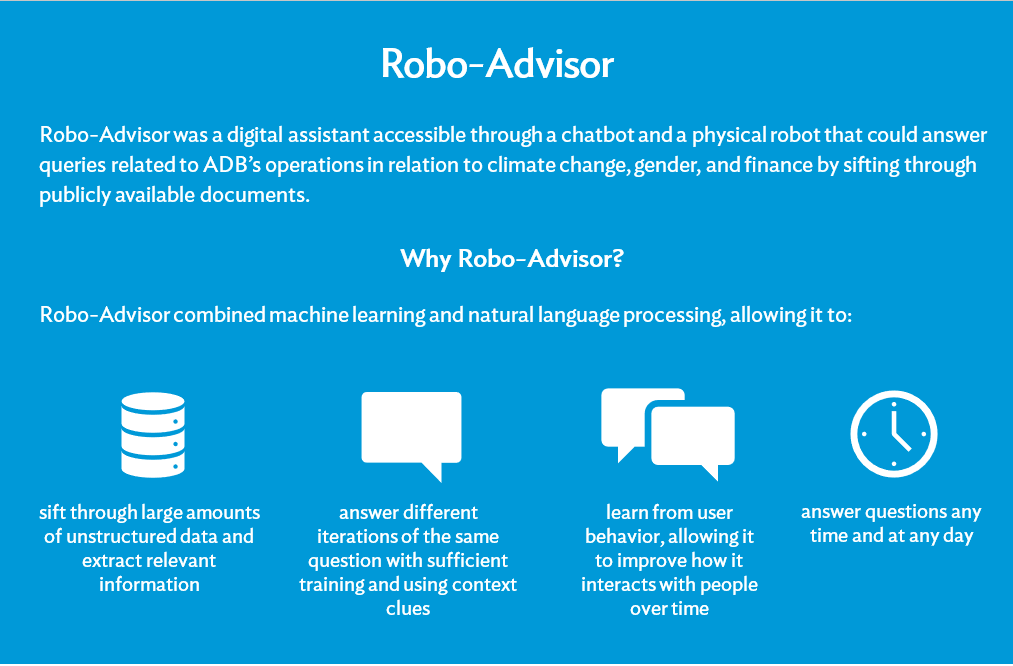

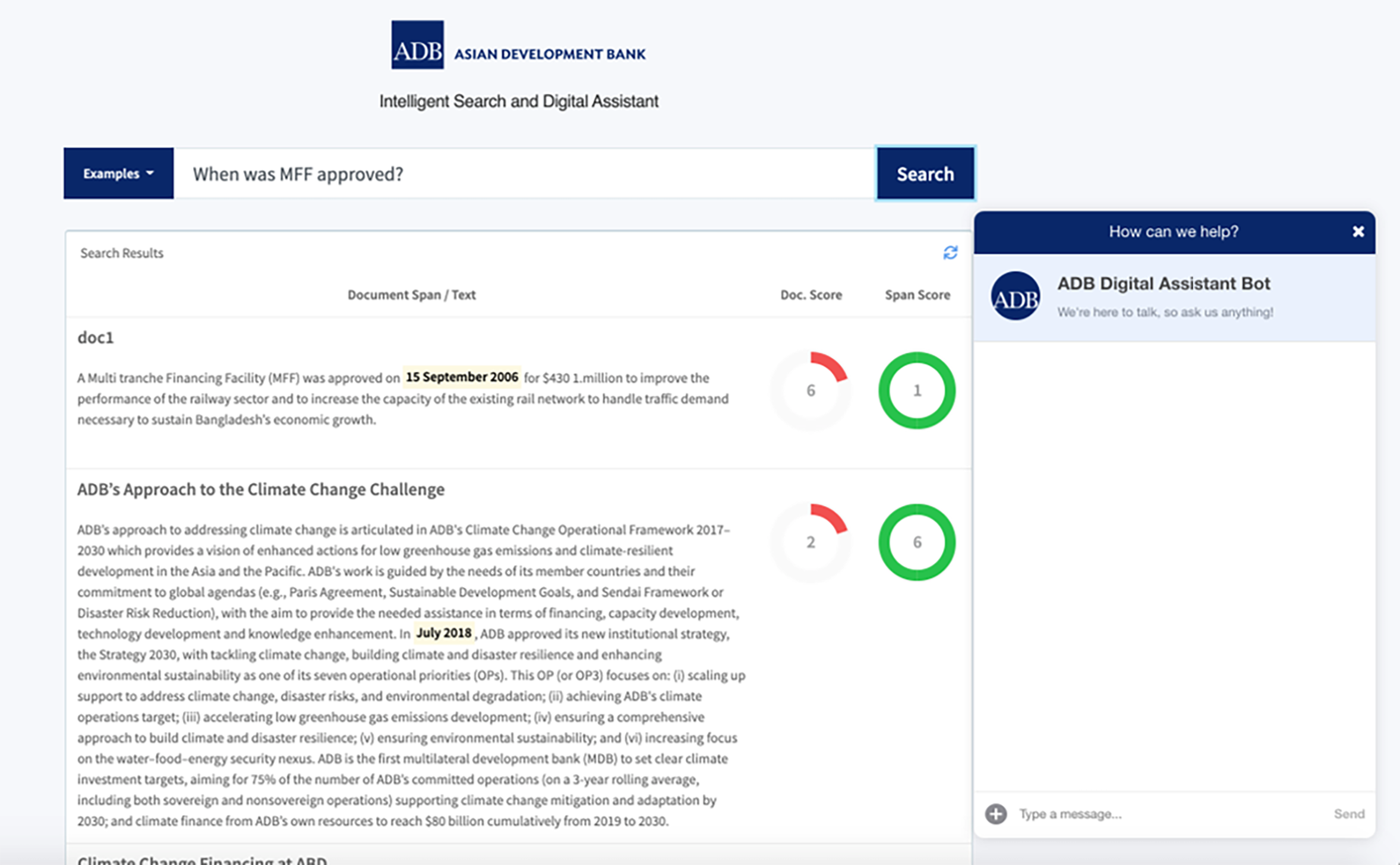

ADB, with the support of Oracle Labs, developed the proof-of-concept (POC) of Robo-Advisor to broaden ADB’s capacity for information dissemination by making it easier for both internal and external audiences to learn about the bank’s initiatives. This was intended as one of the initiatives to promote digital development and innovative technologies, one of the operational approaches identified in ADB’s Strategy 2030. It was also in line with the Digital Agenda, which supported exploring and testing new and emerging technologies to help address business challenges and improve the bank’s agility and responsiveness.

Originally, the POC was only intended to come in the form of a chatbot that answered text-based queries. However, it was later decided to test whether the digital assistant could be integrated with Pepper, a social humanoid and programmable robot, to complement the text-based chatbot app with a voice user interface. The intent was to explore the possibility of using Pepper during events so guests can get more information about ADB’s projects and initiatives in a unique and interactive manner.

The Robo-Advisor POC was trained using publicly available documents in the projects section on ADB’s website. Three thematic areas were covered: climate change, gender, and finance. Meanwhile, an intermediary service was used to integrate Robo-Advisor with Pepper. This was tested during the 3rd Asia Finance Forum in November 2019.

Robo-Advisor demonstration with Pepper the Robot at the 3rd Asia Finance Forum.

The chatbot version would have been beneficial for ADB’s international staff and clientele, who come from different countries and time zones and want to learn more about the organization. Another benefit that the tool offered to ADB was its capacity to provide consistent responses, unlike humans who may provide different answers based on their training and experience. Having a tool that would readily answer queries would have also helped build trust among ADB’s various stakeholders as they would have been able to familiarize themselves with the bank’s operations without needing to sort through thousands of documents or consult with ADB staff and consultants to find answers to their specific queries. However, various issues affected the proof-of-concept implementation. PDF files on adb.org/projects had to be converted into other file formats (e.g., .txt, .xls, .json) and manually reviewed and validated. This limited the data that could be used for training the model. Only 8,000 to 10,000 documents were considered out of the 60,000 documents available on the website at the time.

Questions for Pepper during demonstrations also had to be simple as the voice user interface could not answer long and complex queries.

The advent of the COVID-19 pandemic halted activities related to this initiative. While this was parked, rapidly evolving technology outside of ADB led to the development of better options on the market that are available out of the box, such as ChatGPT, removing the need to develop a custom model for ADB.