ADB Pay: Convenient, efficient, and green cashless payment option at ADB Headquarters

Start of implementation: 2019

Technology type: Fintech

Technology service provider: FlexM

ITD’s Partner ADB Departments: Treasury Department and Corporate Services Department

In line with ADB’s Operational Approach: Promoting digital development and innovative technologies

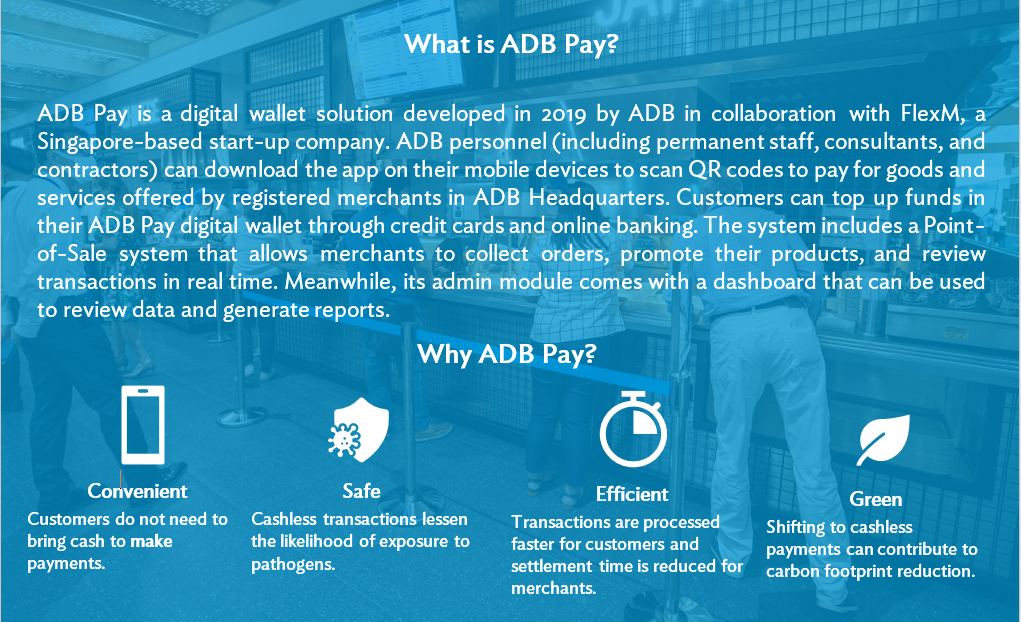

Modernizing the payment process at ADB was identified as one of the ways to meet under Strategy 2030, which envisions ADB’s digital transformation by using modern information and technology systems and digital processes to enhance effectiveness, efficiency, and resilience.

There were various pain points that ADB Pay sought to address:

Merchants. Merchants from over 20 establishments at ADB Headquarters manually processed transactions from as many as 5,000 people (staff, contractors, consultants, dependents, and visitors). This strained their capacity and made human error more likely. In addition, the payment settlement cycle for merchants took 2-4 weeks on average.

Customers. Customers faced long queues, especially during peak hours. In addition, they could not pay using international cards, which made transacting challenging for international staff and visitors.

FlexM, a Singapore-based start-up company, was selected as the technology service provider through ADB’s Open Innovation Platform to implement the digital wallet solution.

FlexM consulted with various stakeholders within ADB to understand their payment process experience, as well as their expectations from the app.

COVID-19 delayed the rollout of ADB Pay, but the pandemic also provided the opportunity to address app issues and enable the system to adapt to the growing volume of users. The soft launch of the app took place in 2021 for 300 essential staff. It was then fully launched in October 2022, targeting the rest of the ADB personnel. Promotional videos, pop-up ads, and e-mail announcements were released to promote ADB Pay and provide information on how to download and use the app.

Sample homepage of the ADB Pay app.

There are over 1,700 customers and 20 establishments registered in ADB Pay as of Q3 2023.

ADB Pay is designed to be scalable. Three of the features that are expected to be rolled out are food ordering from ADB Headquarters’ Executive Dining Room; a feedback form that would allow users to share their experience of using ADB Pay to further improve the app’s performance; and community announcements that would notify users of key events and activities in ADB. Additional features that may be added in the future include expense reimbursements, visitor registrations, mobile banking, and micro-lending. While ADB Pay currently uses a closed-loop system, it has the potential to support open-loop payments to allow users to have transactions with more merchants.

Other country offices of ADB may adopt ADB Pay in the future. The system can also pave the way for financial inclusion initiatives among the Developing Member Countries (DMCs) to serve the unbanked in the region. This can also include potentially supporting cross-border payments and remittances.