Intelligent Integrity Due Diligence Platform: Leveraging Artificial Intelligence to Automate Risk Checks

Implementation: 2019

Technology type: Artificial intelligence (AI), big data

ITD’s Partner Department: Private Sector Operations Department

Technology service provider: Neural Mechanics Inc.

In line with ADB’s Operational Approaches: Promoting digital development and innovative technologies, expanding private sector operations

ADB recognizes the key role played by the private sector in reducing poverty and building climate resilience in Asia and the Pacific. They can help address development and infrastructure gaps, open trade opportunities, and generate gainful employment. The bank aims to grow its private sector operations to support one-third of its total operations by 2024 as part of Strategy 2030. However, ADB is careful to ensure that this expansion does not come at the expense of due diligence. Through PSOD, it continues to conduct integrity due diligence (IDD) to adhere to high standards of corporate governance, integrity, and transparency. Stringent investigations are done to identify real and possible risks posed by existing and potential clients. These measures are taken to ensure that the bank works with and provides funding to reputable partners who are neither involved in illegal, unethical, and disreputable activities nor work with individuals or partners who do so.

PSOD faces various challenges when doing IDD. The IDD process is time-consuming, requiring the manual completion of various checklists for each project. The annual IDD monitoring conducted to ensure risk per project is also completed manually. In addition, some documents may be in a language that reviewers may not be familiar with, thereby requiring more time for translation. These issues can endanger the reputation and operations of ADB and its partners, not to mention put the financial resources that ADB has been entrusted at risk of being funneled to support illegal or unethical activities.

Through the Digital Learning Labs (formerly called the Digital Innovation Sandbox), a safe and neutral facility for ADB to test emerging technologies, ADB’s Information and Technology Department and PSOD tested whether it was possible to use AI to conduct due diligence checks faster and avoid operational and reputational risks at the earliest possible instance. This would also have supported PSOD’s goal of undergoing process change by improving its processes and internal efficiency, as highlighted in the Operational Plan for Private Sector Operations for 2019–2024.

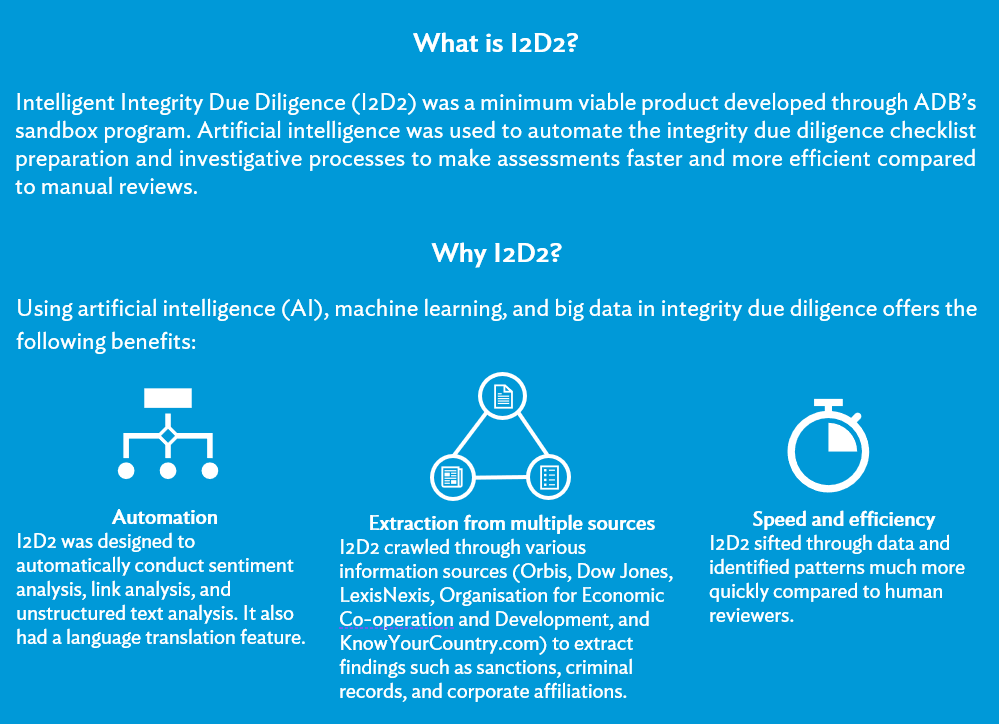

The minimum viable product (MVP) of Intelligent Integrity Due Diligence (I2D2), which was developed with the support of Neural Mechanics Inc. focused on the IDD checklist. Specifically, it supported the IDD checklist preparation through Ultimate Beneficial Ownership (UBO) searches, sanctions screening, adverse media searches, tagging, and footnote referencing to anchor search findings and generation of ownership diagrams where information is available online. The searches and findings were then presented and committed to the databases for easy retrieval and continuous monitoring. The news sentiment feature, meanwhile, assisted in filtering adverse information, enabling users to make faster assessments. The product development stage also aimed to integrate the generation of visual maps to show connections between individuals and organizations across multiple ADB projects. Search functionality was integrated to bring in results from different sources. The MVP was also designed to provide alerts, which were automatically categorized and prioritized as they came in.

Various lessons were learned throughout the process and the insights that were generated served as technical exploration inputs in the development of the Integrity Intelligence System (IRIS), an AI-driven platform that can scan multiple data sources for the screening and ongoing monitoring of sanctions, conducting assessments and investigations, and identifying integrity risk exposure for due diligence.